Subscribe to our email

If we’re not a good fit for you now we might be in the future. Stay tuned to see what we have in store.

Eliminate the guesswork with data-driven systematic trading and Trade By The Numbers.

Download our FREE market structure indicator today.

What do you get with the PRO indicator?

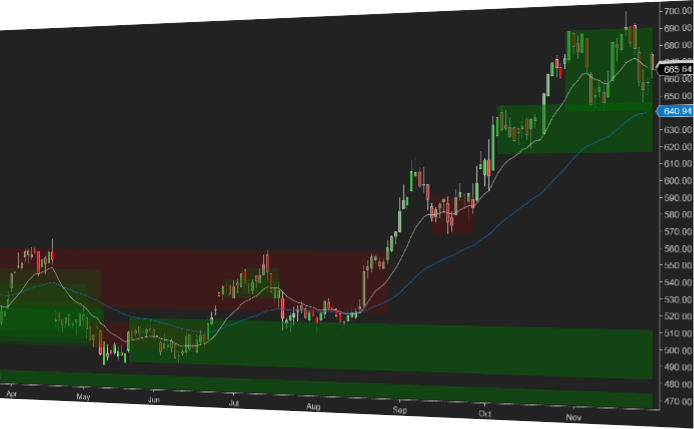

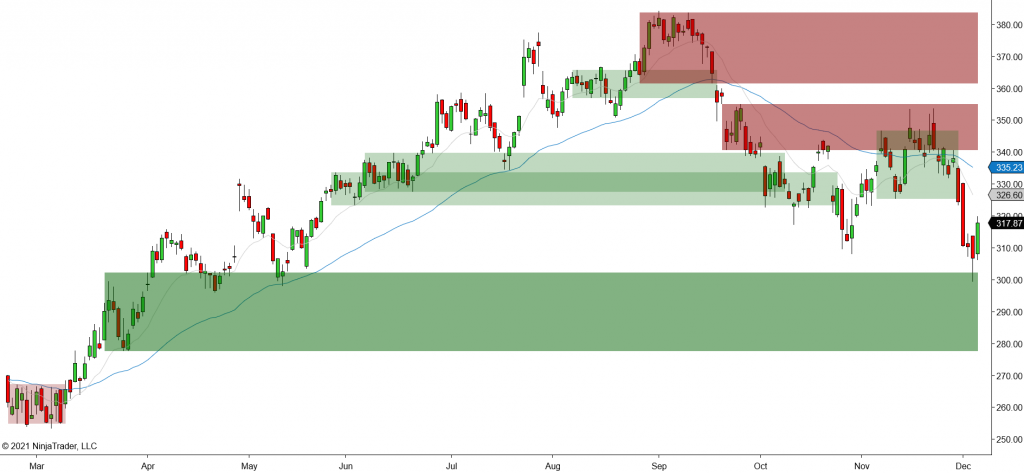

The Buy Sell Zones give us an objective way to analyze market structure. With that we can construct systematic trading strategies, test them over years of historical data, and ultimately deploy those strategies to live markets.

The market structure trend uses the structure of the Buy Sell Zones to determine trend direction. In addition to trend direction you can use the feature to analyze trends across multiple timeframes in the same chart to easily identify confluent trends.

The zones overlap feature enables us to easily identify areas of robust structure defined by overlapping zones. With the overlap feature you can identify confluent structure, not only on your trading timeframe chart, but across any timeframe.

With the zones, and its features, as a foundation you can employ some basic decision criteria for trade execution. Leverage the skills and knowledge you already have as a trader to assemble a simple trading strategy.

Our tools are built by traders for traders.

Let the Buy Sell Zones take your trading to the next level

Apply the indicator to any market and time frame

Measure performance for back testing

Zones are 100% rules based and objective

Fully customizable to suit your trading style

Use the zones to augment your existing strategies

Detect trend and overlapping zones with PRO version

How traders are finding consistency with the Buy Sell Zones

Apply market structure to your trading and automate the process with our powerful indicators.

Learn how to read price action with market structure. Our courses will take you step by step through understanding market structure and applying it to your trading.

Engage with Trade By The Numbers members, share ideas, and discover new trading strategies. Stay tuned for how to join the community!

Simply click any of the download links on the site, or click here, and fill out the form. After submitting the form you will receive an email with a link to download the indicator and installation instructions.

The free version includes our Buy Sell Zones LITE indicator. With the LITE version you can leverage the Buy Sell Zones without the added benefit of the trend and overlap PRO features.

With the PRO version detecting market structure trend and overlapping zones, within the same time and across timeframes, is automated.

Currently our indicators are only supported on the NinjaTrader platform. If you’re not familiar with NinjaTrader you can get setup for free here. We are working on supporting additional platforms. Stay tuned for more information!

If we’re not a good fit for you now we might be in the future. Stay tuned to see what we have in store.

Risk Disclosure

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

Provide your name and email. After submitting the form you will receive an email with the indicator package and installation instructions.

Drop us a note and we’ll get back to you soon.

NinjaTrader® is our #1 recommended trading software preferred by traders worldwide including our clients.

Download NinjaTrader & receive immediate FREE access to:

NinjaTrader’s award-winning trading platform is consistently voted an industry leader by the trading community. Featuring 1000s of Apps & Add-Ons for unlimited customization, NinjaTrader is used by over 60,000 traders for advanced market analysis, professional charting and fast order execution.

For new traders, start preparing for the live markets with a free trading simulator featuring real-time market data.

Kinetick® delivers reliable, fast and cost-effective market data to help level the playing and forex that exceed the expectations of the world’s most demanding traders, like us!

Get started with FREE end-of-day historical market data directly through the exchange fees on real-time market data with Kinetick.

Risk Disclosure

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.